Bussiness

Scotland urged to fast-track investment zones and freeports amid foreign investment dip

Wright, Johnston & Mackenzie is calling for accelerated progress on investment zones and freeports to bolster economic growth, after its analysis showed a concerning downturn of foreign interest in Scottish businesses.

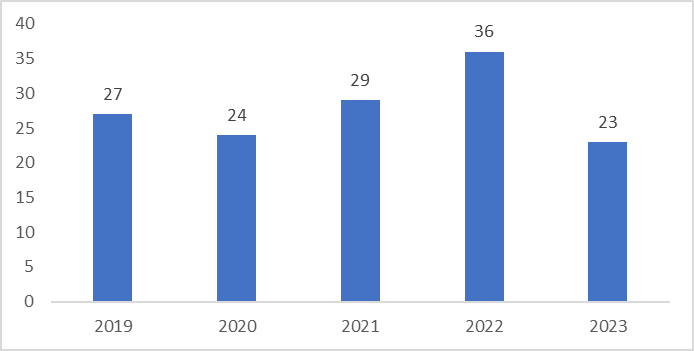

The specialist business lawyers analysed industry data, indicating a significant drop in overseas investment activity targeting Scottish firms. In 2023, only 23 Scottish businesses were subject to overseas deals, compared to 36 in 2022.

The research says foreign investment in the UK is increasingly concentrated in London and the South East, with these areas accounting for 42% of deals in 2023, up from 35% in 2019.

Fraser Gillies, managing partner at Wright, Johnston & Mackenzie, said: “This new research highlights that investment activity in the traditional FDI hotbed in the South East of England has increased, whilst in Scotland, deal activity has been rising steadily over the last five years but reduced in the most recent twelve months.

“Government initiatives such as freeports and investment zones could be a game-changer for providing favourable conditions for UK-based businesses, attracting more interest and investment from abroad, and levelling up the economy.

“Making the UK the top investment destination in Europe, attracting new investment into communities and helping to level up the country, is one of five key priorities for the Department of Business & Trade.

“Providing tailored support for each investment zone and promoting what Scotland has to offer on an international stage is a crucial part of this.”

Volume of overseas investment deals into Scotland (source: Experian, Wright, Johnston & Mackenzie analysis)

Investment zones and freeports aim to drive investment and innovation across the UK, offering a favourable environment for businesses to grow.

The UK government says it is committed to establishing 13 investment zones across the UK and last summer, together with the Scottish government, it announced the Glasgow City Region Regional Economic Partnership and the North East of Scotland Regional Economic Partnership.

The expectation is that many of the zones will go live in spring 2024 but so far Liverpool is the only zone to have officially done this, announcing details of its proposition last month. Experts at Wright, Johnston & Mackenzie say it’s imperative for the country’s future growth that those in Scotland are brought forward as soon as possible.

Designed to also boost economic activity and the ‘levelling up’ agenda by fostering trade, investment and job creation around maritime ports and airports, freeports allow goods to be imported without the usual tariffs. Additionally, companies operating within freeports can enjoy reduced property taxes and national insurance rates, further incentivising business growth and new employment within these zones.

Scotland is set to establish two new freeports, one at the Firth of Forth and another at Inverness & Cromarty Firth, as part of a joint initiative by the UK and Scottish governments.

The Forth Freeport aims to draw £6 billion in investment, create 50,000 jobs, and contribute £4.2bn to the local economy within five years, focusing on sectors like renewable manufacturing and shipbuilding.

The Inverness & Cromarty Firth Freeport is expected to generate 16,500 jobs and £3bn in investment, emphasising renewable and low-carbon energy sectors to support the transition to net zero. Both sites will include significant expansions and developments to foster innovation and skills growth.

Foreign direct investment (FDI) refers to an investment in an enterprise operating in a foreign economy, where the purpose is to have an ‘effective voice’ in the management of the organisation. According to the latest ONS data, FDI into the UK has increased year-on-year for a decade to stand at over £2 trillion by 2021.